Business Insurance in and around Northville

Get your Northville business covered, right here!

No funny business here

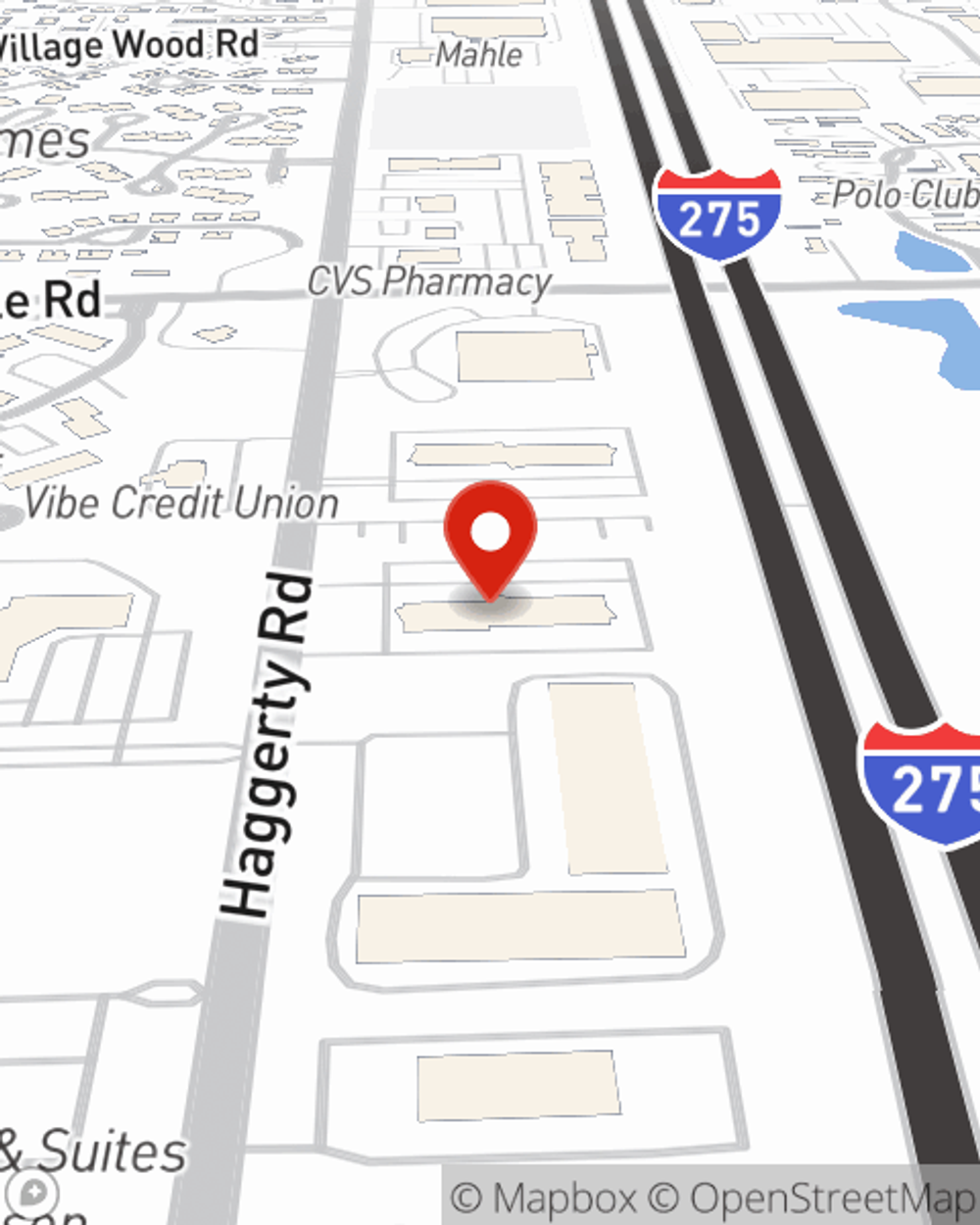

- Northville

- Novi

- Plymouth

- Livonia

- Farmington Hills

- Farmington

- Commerce

- South Lyon

- Ann Arbor

- Wixom

- Walled Lake

- Milford

- Canton

- Whitmore Lake

- Brighton

- Howell

- Hartland

- Westland

- Ypsilanti

- Belleville

- West Bloomfield

- Bloomfield Hills

- Chelsea

Business Insurance At A Great Value!

Whether you own a an antique store, a pharmacy, or a home improvement store, State Farm has small business coverage that can help. That way, amid all the different moving pieces and options, you can focus on making this adventure a success.

Get your Northville business covered, right here!

No funny business here

Get Down To Business With State Farm

When one is as dedicated to their small business as you are, it makes sense to want to make sure all bases are covered. That's why State Farm has coverage options for business owners policies, commercial liability umbrella policies, surety and fidelity bonds, and more.

Let's discuss business! Call John O'Leary today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

John O'Leary

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.